- MAIN PAGE

- – elvtr magazine – SIX WORLD’S LARGEST PYRAMID SCHEMES

SIX WORLD’S LARGEST PYRAMID SCHEMES

According to a study by the American edition of CNBC, in 2019, pyramid schemes broke the record for the last 10 years. In the U.S. alone, federal authorities uncovered 60 fraudulent schemes this year that attracted more than $3 billion in "investments."

The popularity of pyramid schemes is also growing in Europe despite the sad experience of the 2000s.

We analyzed the most sensational cases of pyramid schemes and how they work.

The Definition of Pyramid Scheme and How It Appeared

The pyramid scheme is a fraudulent business model. The profit of its first participants is provided at the expense of people who joined the scheme later and not through the sale of a product/service.

The trick is that it is impossible to pay profit to all the scheme participants. The creators of the scheme are well aware of this. The pyramid scheme works as long as there is a steady inflow of "investors" and their money. When new participants stop investing, it is not possible to pay profit to old participants, and the pyramid scheme collapses.

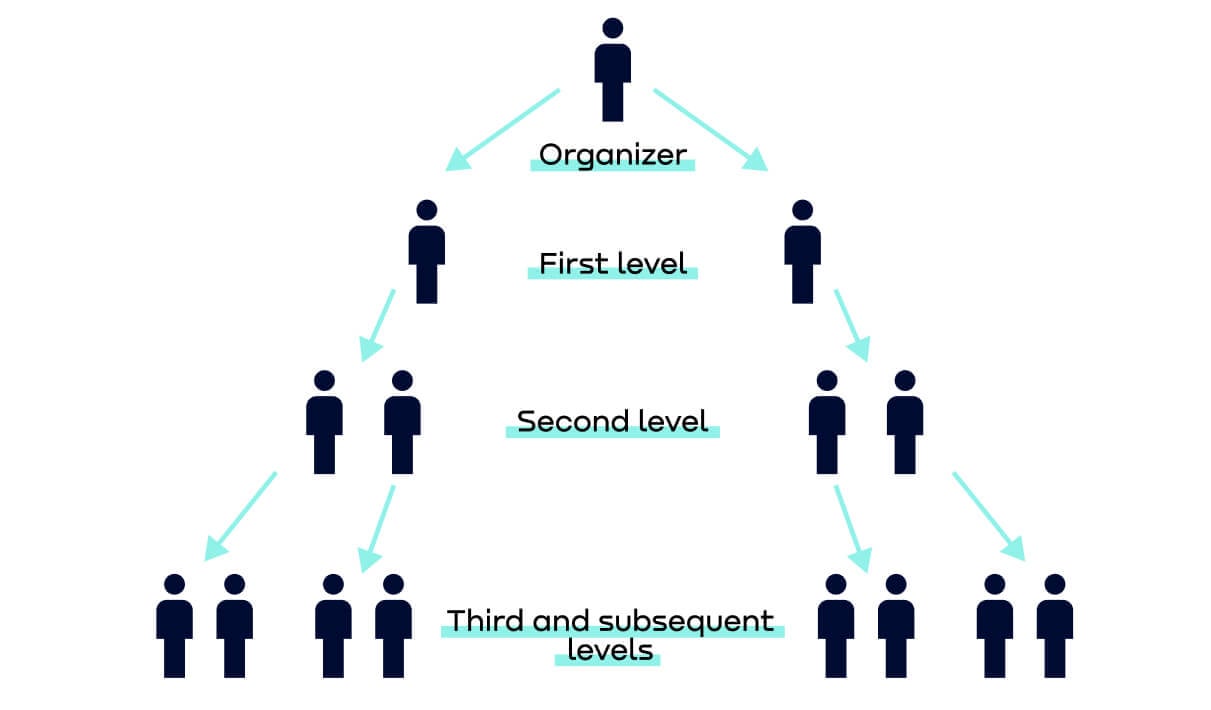

This scheme got its name because of its structure – a large number of "investors" at the lower level provide profit to a smaller number of participants who are one step higher.

The Ponzi scheme is at the heart of the pyramid scheme. The Italian immigrant Charles Ponzi invented this fraudulent business model in 1919. He arrived in the USA with $2.5 in his pocket, but he could not make money legally. Then the scammer Ponzi came up with a cunning scheme for easy but risky earnings.

Charles founded The Securities Exchange Company, which sold promissory notes: the "investor" invested $1,000, and the company promised to pay him $1,500 in 90 days. Where could 50% profit in 3 months come from? It turns out that Ponzi did not conduct any transactions. His company got that "profit" from the money of new scheme participants.

In 1920, the pyramid burst out, but Charles was the first to enrich himself by $ 20 million this way. However, his followers earned ten times more.

Although the concepts of "pyramid scheme" and "Ponzi scheme" are considered synonymous, they have some differences, namely:

- life span: classic pyramid schemes last less. They focus only on a steady inflow of new investors while Ponzi schemes also try to retain the old ones.

- legal status: Ponzi schemes are open fraud while pyramid schemes can sometimes be part of a legitimate business.

- operation structure: pyramid schemes require "investors" to bring in new people. The participant receives a commission from each of them and only then sends the money "up". In Ponzi schemes, the funds received are immediately used to pay the profit to earlier investors.

Main Features of Financial Fraudulent Schemes

Here are 5 common features that will help recognize a Ponzi scheme or pyramid scheme in an investment fund:

- guarantee of high return on investment with minimal or no risk (impossible)

- the market situation does not affect profitability (impossible)

- lack of data on the source of income (unlikely)

- the fund does not disclose the details of the investment strategy (probably it just does not exist)

The Largest Pyramid Schemes in History

#1. Madoff Investment Securities

Investors’ losses: $65 billion

It was the largest pyramid scheme in history, disguised as an investment fund. Its creator, Bernard Madoff, was one of the founders of the NASDAQ stock exchange and a well-known philanthropist.

In 1960, he founded Madoff Investment Securities. The company was engaged in the purchase and sale of securities on the stock exchange and was considered one of the most reliable investment funds on Wall Street.

Madoff had an excellent reputation as he donated millions of dollars to charity. His company was one of the top 25 largest in the stock markets and consistently paid its investors huge annual returns – 12%. Major global banks and celebrities were among Madoff Investment Securities' investors. They all thought that Madoff had some insider information and, therefore, his fund could pay such interest.

However, 40 years later, it was revealed that the businessman paid old investors from the funds invested by new clients. That is, he acted following the classic Ponzi scheme. Madoff’s sons found out about this and turned him in to the authorities.

The largest financial fraud affected 3 million people, and at least 4 people died. Several bankers and the son of Bernard, who betrayed his father, committed suicide.

Madoff was sentenced to 150 years in prison for fraud. He has been in prison since 2009.

#2. МММ

Investors’ losses: > $2 billion

MMM was the largest pyramid scheme in Eastern Europe. The residents of the region affected by it forgot about investments as passive income for a long time. Its collapse was a disaster for millions of people.

In 1989, a resident of Moscow, Sergei Mavrodi, his brother, and his wife founded the MMM Company. This small company sold office equipment throughout the Soviet Union. The business was successful, and by the beginning of the 90s, MMM had become the market leader.

However, after scaling, the company run into legal problems. The tax inspectors accused MMM of tax evasion. It became difficult to do business, and Mavrodi decided to switch to the financial sector.

At first, MMM tried to sell American shares. Though, this business was unsuccessful, as investors did not trust them. Then Mavrodi decided to issue his own shares with a face value of 1,000 RUB. It was 1994, and that is how the history of MMM as a pyramid scheme began.

The company's securities got more expensive daily, although there was no real reason for this. Brilliant advertising and loud slogans like "today it is more expensive than yesterday" did their job. The TV broadcasted the first message that MMM paid its shareholders' dividends in the amount of 1000% per annum. The number of investors increased rapidly.

Interestingly, Mavrodi set the value of MMM shares himself. Twice a week, he personally announced new prices for their purchase and sale.

In just six months, the value of MMM securities increased 127 times. In 1994, the company promised its shareholders to pay 3000% per annum dividends. Since MMM was a classic pyramid scheme, high interest on old deposits was paid only at the expense of attracting new ones.

There was enough money to pay investors until July 27, 1994. After that, Mavrodi reduced the value of the company's shares by 127 times – to 1,000 RUB, as at the time of their first issue. The pyramid scheme collapsed.

Immediately after this news, 50 people committed suicide. Riot police stormed the MMM office and Mavrodi's apartment. The founder of the pyramid scheme was arrested for tax evasion. According to him, MMM affected about 15 million people.

#3. Stanford International Bank

Investors’ losses: $8 billion

Robert Allen Stanford founded a huge pyramid scheme disguised as a bank.

In 1983, Allen Stanford started selling real estate in Florida but failed to do it legally. As a result, the businessman relocated his business to Antigua and Barbuda – offshore in the Caribbean. In this island state, it was possible to escape from US tax inspectors and safely run "business". In 1986, Stanford opened Stanford International Bank there.

The "bank" issued certificates of deposit as an alternative to a deposit. Stanford International Bank offered much more attractive terms than others in the market: for example, the yield on such certificates was consistently higher than in other banks. Suspicious clients were convinced that the certificates were fully backed by the assets of Stanford International.

In addition, Allen forged the "bank" documentation so that no one would know of the true state of affairs. The truth was that high interest payments on certificates of deposit occurred only due to the arrival of new investors and their money. It was a classic pyramid scheme.

The "bank" operated for 23 years. During this time its founder appropriated about $8 billion from investors. Stanford International Bank attracted funds not only in the USA, but also in the Caribbean and South America.

The US authorities disclosed Stanford only in 2009 as the company location played into his hands for a long time. In 2012, the billionaire was imprisoned for 110 years for creating a fraudulent scheme.

#4. European Kings Club

Investors’ losses: $1.1 billion

This largest European pyramid scheme operated in Switzerland, Germany, and Austria from 1992 to 1994. About 94 thousand people were involved in it. In some Swiss cantons, every tenth was affected by the Club.

The European Kings Club was to be a place for selected entrepreneurs of small and medium businesses where they could receive financial support. To join the Club, you had to buy a "letter" – a share of the Club for 1,400 German marks (about $800 today). At the same time, the Club representatives promised to pay investors 200 German marks every month. This was a very high return for an organization that was only engaged in the sale of shares.

The pyramid scheme continued to operate until the German and Swiss authorities arrested the founders of the Club, Damara Bertges, and her associate for fraud. This caused riots in Switzerland, Austria, and Germany as investors refused to admit they were being scammed. They even demanded the release of scammers because at the time of disclosure, the pyramid scheme was still working.

As a result, during the search for the Club, the tax inspectors seized 500 million German marks and returned them to investors. However, the shares themselves were sold for a colossal amount – 1.6 billion francs ($1.8 billion).

Despite the scale of the scam, the organizers of the scheme were imprisoned for only 5 years.

#5. Caritas

Investors’ losses: $1 billion

This was a pyramid scheme which involved half of the population of Romania. During the year of its existence, the scammer John Stoica deceived 4 million people. It is worth mentioning that the state helped him in this scheme.

In 1992, John Stoica founded the Caritas company to financially "help" the population of Romania during the problematic 90s. The name of the scheme was well thought out: Caritas means "mercy" in Latin. This word was consonant with the name of the world's charitable organizations, which inspired confidence. And the Romanians believed John.

Caritas promised extortionate interest: 800% in 3 months. The deposits were initially limited to $50. Then the minimum amount increased to $100, and the maximum to $800. This was a lot of money for Romanians, but Caritas became very popular among people – every second Romanian invested in this scam.

TV and politicians played a considerable role in the distribution of Caritas. Georg Funar, a member of the Nationalist Party of Romania, patronized the organization. He was also the mayor of the city of Cluj and even rented out part of the city administration to Caritas. Funar paid a local newspaper to publish a list of "lucky ones", which multiplied their investments by 8 times. This pyramid scheme collapsed in a month.

Although all this time the Romanian government was aware of the illegal activities of Caritas, even the president of the country did not dare to intervene. The government was afraid of street protests and the reaction of angry investors.

Before bankruptcy, Caritas attracted about $3 billion. During the most "successful" days, the organization possessed ⅓ of all Romanian banknotes. The organizer of the pyramid scheme spent 1.5 years in prison. Georg Funar is still in politics – in 2014, he ran for the presidency of Romania but lost the elections.

#6. Mutual Benefits Corporation

Investors’ losses: $1.25 billion

Joel Steinger, an experienced scammer, organized this pyramid scheme. This organization was peculiar for making money on death.

In 1994, Steinger founded the Mutual Benefits Corporation, although according to the documents, he was only an advisor. By then, the US Securities and Exchange Commission had banned Joel from selling securities. But that didn't stop him.

Mutual Benefits Corporation made money on viatical settlements – shares on life insurance policies for terminally ill people. The essence of the fraud was that the patient was selling his insurance to others, knowing he was unlikely to need it. It was beneficial for such a person as he received a one-time income from the buyer during his lifetime and not a death benefit from the insurance company.

The viatical settlement buyer also benefited as he became the new owner of the insurance policy, paid monthly dues, and received payments on it in case of the death of the previously insured.

Mutual Benefits Corporation purchased insurance policies from patients, resold them to third parties, and became an intermediary between the insurance company and the new owners of the shares. The latter made monthly contributions and Mutual Benefits in return, promising them a good percentage of the death benefit payment. Unless, of course, the first owner of the insurance policy really died.

This scheme was deliberately complicated to confuse potential investors. All the investors had to do was bring their money to Mutual Benefits Corporation. Then the company's employees provided investors with fake reports about the "deadly" diseases of the policyholders. Allegedly, they should receive their percentage of the death benefit payment from the insurance company. Though no one died massively, so the scammers had to pay interest to old investors with the money of new ones. This is a classic Ponzi scheme.

In 2001, a doctor who faked patient diagnoses for Mutual Benefits handed over Joel Steinger to the police. In 2014, the scammer was imprisoned for 20 years.

The company operated until 2004, selling 30,000 life insurance policies for $1.25 billion.

Films/Books About Pyramid Schemes

#1. "The Wizard of Lies" (2017)

This film tells how Bernard Madoff managed to deceive fellow bankers and hundreds of thousands of private investors for 40 years. The plot is based on actual events – the so-called "Bernard Madoff scam", the largest in history. Robert De Niro plays the lead role. The film's tagline is "Only those you trust can truly betray you".

#2. C. Cross "Anatomy of a Ponzi Scheme: Scams Past and Present: True Crime Tales of White Collar Crime"

In this book, the author gives a complete picture of the Ponzi scheme and tells about the history of its creator, the principles of operation, and the most scandalous cases. In addition, Cross wrote about how to recognize this fraudulent scheme so that the reader could be more careful.

The book's main feature is dispelling myths about the parties involved in such business models. There is an opinion that gullible people who want quick and easy money usually become investors in Ponzi and pyramid schemes. However, sometimes investors may not even know to who they entrusted their money. For example, pension fund investors had no idea that it was involved in the structure of the Bernard Madoff scam. Therefore, they were shocked by the loss of their funds. This book makes it clear that no one is safe from financial fraud.

#3. "Betting on Zero" (2016)

Documentary directed by Ted Brown. This is a mini-investigation of the activities of the US company Herbalife, which specializes in healthy nutrition. In the film, the director provided evidence and facts that the transnational Herbalife is a financial pyramid that will soon collapse.

*ELVTR is disrupting education by putting proven industry leaders in a virtual classroom with eager rising stars. ELVTR courses offer 100% instructor driven content designed to give you practical knowledge within a convenient time frame. Choose the right course for you!